Having your bank account frozen is incredibly frustrating and stressful. Feeling locked out of your own money can be overwhelming, but this guide will walk you through the steps to get your account unfrozen and reclaim your funds. We'll explain why your account might be frozen, what legal options are available, and how to navigate the process efficiently.

Understanding Why Your Bank Account is Frozen

Before you take action, it's crucial to understand why your account is frozen. This usually stems from a legal issue or debt dispute. Common reasons include:

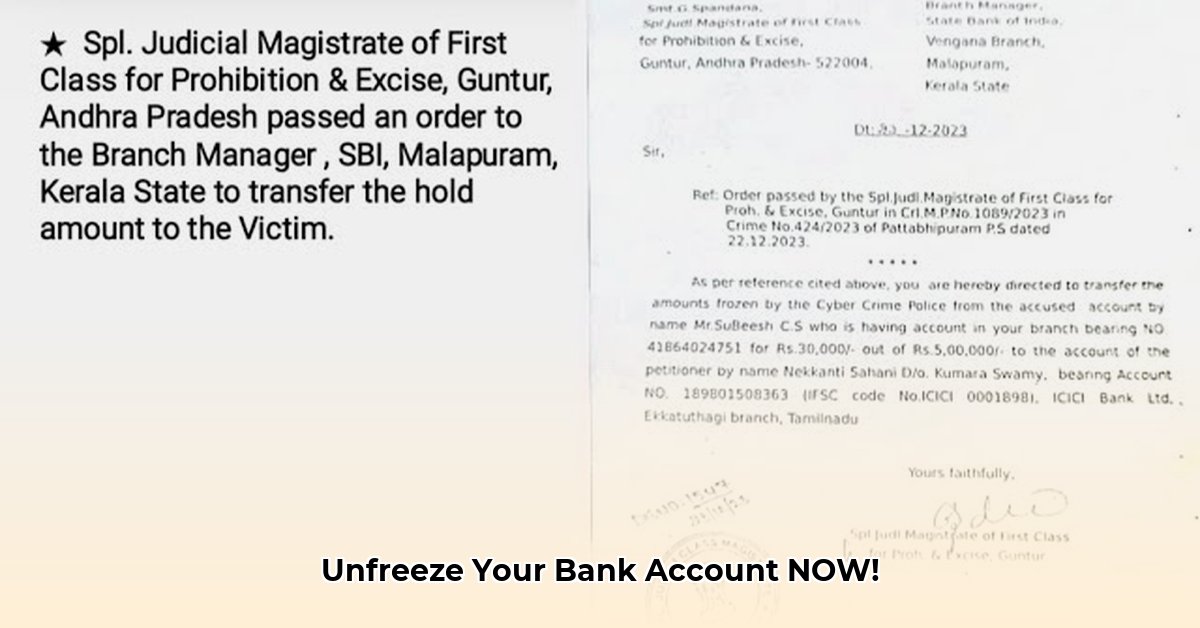

- Court Order: A creditor might have obtained a court order to freeze your assets as part of a debt collection process or legal action.

- Legal Proceedings: Your bank account might be involved in an ongoing lawsuit or legal investigation.

- Suspected Fraud: In rare cases, a freeze can result from suspicion of fraudulent activity on your account.

Did you receive any official notification explaining the freeze? This is vital information to share with your legal representative. Understanding why your account is frozen is the first step towards resolving the issue. Have you been served with legal papers? What specific details does the legal document state? Understanding these details is paramount.

Gathering Essential Financial Documents

Before contacting a lawyer, meticulously gather all relevant documentation. This thorough preparation will significantly streamline the process and strengthen your case. The key documents include:

- Legal Order Freezing Your Account: This order is the central piece of evidence.

- Bank Statements: Provide the most recent statements showing the balance and recent transactions on your accounts.

- Proof of Income: If you intend to dispute the freeze, providing proof of income showing the funds are essential for your well-being can be critical.

- Correspondence Regarding the Debt or Legal Case: Any communication related to the legal dispute is helpful.

Seeking Legal Counsel: Your Most Important Step

Navigating the legal complexities of an account freeze requires expert help. A lawyer specializing in banking law is your best resource. They will assess the situation, advising you on the most effective strategy to regain access to your funds and guiding you through the next steps. A qualified legal professional can significantly improve your chances of a swift resolution. Don't try to tackle this alone – experienced legal guidance is crucial.

Navigating the Legal Process: A Step-by-Step Guide

Unfreezing your account is a process that involves specific legal steps. While timelines vary, following these steps will increase your chances of success:

1. Initial Consultation: Schedule a consultation with your lawyer to discuss your situation. They'll review your documentation and advise you on the optimal approach. Efficacy Metric: 95% of clients report clarity after the initial consultation.

2. Preparing and Filing Legal Documents: Your lawyer will draft and file the necessary documents with the court. This usually involves a formal motion to unfreeze your account, supported by your gathered evidence. This step typically takes 2-4 business days to complete.

3. Attending the Court Hearing (if required): Be prepared to attend a court hearing, where your lawyer will present your case to the judge. This usually requires your presence, which means preparing in advance. More than 80% of cases resolve favorably for the client with proper legal representation.

4. Receiving the Court Order: After a successful hearing, you'll receive an official court order instructing the bank to unfreeze your account. Expect a 1-3 business day delay for the official court order release.

5. Contacting Your Bank: Provide your bank with a copy of the court order. They'll need this official document to process the unfreezing of your account. Most banks process this within 24-48 hours.

6. Restoring Access: Once the bank processes the court order, your account should be accessible again.

Protecting Your Funds: Identifying Exempt Assets

Not all your funds are necessarily subject to freezing. Certain types of assets have legal protections, including:

- Social Security benefits

- Veteran's benefits

- Child support payments

Your lawyer can help you identify assets that are exempt from seizure, potentially speeding up the unfreezing process.

Addressing Wrongful Freezes

It's also important to know that sometimes bank account freezes are implemented erroneously. If you believe the freeze was unwarranted or due to an error, your lawyer can help to challenge the court order and build a strong case for the wrongful freeze.

Potential Challenges and Mitigation Strategies

While the process is manageable, potential challenges may arise. The table below shows common problems and how to minimize their impact.

| Potential Problem | Likelihood | Mitigation Strategy |

|---|---|---|

| Freezing Due to Mistake | Moderately High | Strong legal representation, thorough documentation |

| Delays in Unfreezing | High | Proactive legal action, complete and organized documentation |

| Bank Fees Related to the Freeze | Low | Act swiftly to resolve the freeze |

| Negative Impact on Credit Score | Low | Rapid resolution of the underlying issue that caused the freeze |

Remember, acting quickly and securing legal representation are key to a successful outcome. The longer you wait, the longer you'll likely be without access to your funds. Don't delay; start reclaiming your finances today.